Transparency Good Practice

As the value of being connected to communication infrastructure grows, those without access are increasingly left behind. In order to ensure everyone has affordable access to communication more transparency in the telecommunications sector is required to better understand who is unconnected and what opportunities exist to solve connectivity challenges. Adopting Open Data policies and approaches in telecommunications will enable a more constructive debate on access among civil society organisations, government, and industry.

This site exists to examine specific aspects of telecommunications infrastructure and look at examples of good practice in transparency in those areas. This includes fibre optic backbone infrastructure, tower networks, wireless spectrum assignments, and national backhaul network pricing.

A more detailed rationale for Open Data in the telecommunications sector can be found at https://manypossibilities.net/2018/05/open-telecom-data-moving-forward/

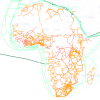

The spread of undersea fibre optic cables around Africa since 2009, followed closely by the rapid spread of terrestrial fibre optic infrastructure, is nothing short of a revolution. It has spread far faster that anyone would have imagined possible. There are perhaps only two or three countries in Africa that do not now have a national fibre optic backbone. Many countries have several. Fibre optic networks are the deep water ports of the Internet; they enable broadband capacity at orders of magnitude larger than any other kind of access technology and at very low latency. For terrestrial networks in particular, the capacity of this infrastructure is so great that it is effectively a non-rival resource: access for one service provider does not diminish opportunity for other providers.

This has tremendous potential to level the playing field in terms of access provision. Any would-be service provider with affordable access to a fibre optic backbone has the potential to be a serious competitor to more established network operators. The reluctance of operators to share this information betrays an apprehension that it may somehow compromise their competitive edge. But in many cases, operators have simply not considered the issue from a strategic perspective. While the majority of operators are reluctant to offer any detailed information about their fibre networks, their response stands in stark contrast to companies like Dark Fibre Africa in South Africa and regional operator Liquid Telecom who readily publish maps of their fibre networks. Dark Fibre Africa stands out in the detail and ease-of-use of their maps. This sort of good practice is easily replicable by other operators. It is just a case of changing the norms.

Taking this information out of the narrow group of stakeholders within which it resides and opening it up to public input and discussion can have multiple benefits. For example, a small rural municipality might determine from a public fibre map that it is in their interest to invest in 50 kilometres of fibre network to connect to a nearby network. A province or state might determine that their region is suffering due to a lack of fibre infrastructure investment. A school or a hospital could fundraise for better access if they can show that a fibre optic cable is within a reasonable distance. From a national strategic perspective, fibre optic infrastructure is now comparable in terms of importance with other basic infrastructure like roads, railways, and bridges. The public should be aware of it in order to identify opportunities to connect to it and to identify gaps where more investment is needed. Making this information public can also be good for operators who can use the scope of their investment in fibre infrastructure to market their services.

Public access to information on mobile tower locations is also essential. Why? Because in terms of understanding who has network coverage we currently rely on mobile network operator coverage maps. Mobile network operators do not have the best incentives to be completely rigorous in publication of their network maps. As it becomes more strategically important to connect every citizen, it becomes equally essential to understand exactly who does and who does not have network coverage. The simplest way to validate network coverage claims is to know where the towers are, which operators are on them and what technology (i.e. 2G, 3G, LTE) they are using on that tower.

A common push-back to this suggestion is that publishing tower information would compromise the security of the networks. In fact, towers locations are already reasonably well-known. First, they are easily visible to the naked eye and thus not hard to locate. Second, many if not most of them can be identified through online services like OpenCellID or through Mozilla’s Location Service. These two resources are brilliant but a limitation of their crowd-sourced approach is that they depend on someone (who has their software installed on their phone) being near a tower in order to detect it. To date this approach has been successful in picking a large percentage of the towers in many countries. However, the more remote towers where populations are sparser tend to not get picked up. And it is exactly in these more remote areas that operators are least incentivised to cover, that we want to know more about coverage. Thus having public tower location information would be extremely valuable from the point of view of mapping the unserved and in terms of identifying opportunities for new business models to offer coverage.

Once the end of the fibre network is reached, it is wireless technologies that typically deliver the last/first mile of connectivity to citizens. Wireless technologies are dependent on national regulatory authorities to grant specific permission to use any given set of radio frequencies. To become a wireless network operator, a license to operate radio equipment within a given set of frequencies is typically required. The one exception to this are the ISM or unlicensed bands (used by technologies like WiFi, Bluetooth, et al.) which do not require a specific license but are regulated through requirements related to their design and operation, e.g., power output. Twenty years ago, when mobile networks were just getting off the ground and most of the Internet was carried over copper wires, obtaining a spectrum license was effectively a simple administrative process. Now that demand for wireless spectrum has significantly increased, spectrum licenses have become valuable assets often sold at auction for millions (and even billions) of dollars.

In the world of spectrum management, there are three key terms: allocation, assignment, and use. Allocation refers to the designated use of a particular band of spectrum, typically as determined through the International Telecommunication Union (ITU) but ultimately decided upon by national governments. These allocations are the product of years of negotiation and consensus-building through the ITU.

Most countries publish their chosen national spectrum allocations. Unfortunately, such information doesn’t tell you much more than the designated purpose of a given spectrum band. It doesn’t tell you who has the right to use it i.e. who has a license in that frequency or whether that frequency is actually in use. It can also look somewhat impenetrable to the casual observer with lots of acronyms that are not self-explanatory. What we really want is information on who has been assigned a given frequency, i.e. given a license to operate in a given band and on what terms that license has been granted.

Why is public access to information on spectrum assignments important? Because often there are opportunities to better take advantage of existing spectrum. You may have read about how a Mexican non-profit is using low-cost GSM technologies to deliver affordable access in the state of Oaxaca. The Mexican regulator has set aside a small amount of GSM spectrum specifically for the purpose of enabling rural access. This is an inspiring model that deserves to be replicated elsewhere. But without information on spectrum assignments, it is challenging to understand where those opportunities are.

Comprehensive public information on spectrum assignments would be a great leap forward but we can go even further and identify whether spectrum is actually in use i.e. not just whether an organisation has received permission to utilise a given frequency band but whether they are indeed using it.

Demand for broadband is increasing non-linearly in Africa, with the result that backhaul networks are fast becoming the critical bottleneck in affordable access. As we have seen, there is a lot of fibre across Africa but the cost of terrestrial links is often so high as to make operator expansion impractical. This is not a problem if you happen to own the fibre (as many incumbent operators do) but it can be a significant obstacle for new operators. This is not a simple challenge to address but one small thing we can do is introduce more transparency in terrestrial network backhaul pricing. The cost per Mbps varies dramatically across the region. Regulators may simply be unaware of how their country stacks up in terms of national backhaul pricing. The same may be true within countries. A little transparency would go a long way. This is not to suggest to operators that they reveal their business agreements but a basic rate card that would establish a ceiling for costs. In fact, a single data point such as the price of an STM-1 (155Mbps) link across 250km would provide critical insight into the competitiveness of the market.